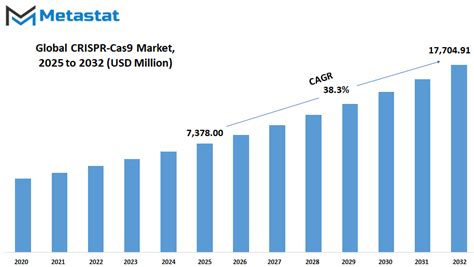

The Economic Impacts Of Crispr Cas9 shape investment decisions, startup milestones, and market expectations in biotech. This article explores how the gene-editing breakthrough translates into real-world economic signals for founders, investors, and policy makers. By tracing cost curves, project timelines, and collaboration networks, we can map the financial contours of a field that blends science and markets.

Key Points

- R&D timelines shorten as standardized CRISPR Cas9 workflows accelerate proof-of-concept, speeding time-to-market for new therapies.

- Capital allocation shifts toward early-stage rounds with a clearer pathway to milestones and reduced upfront capex.

- Platform services and CRO networks emerge, lowering barriers to entry and enabling scalable, recurring revenue for startups.

- Pricing pressure and competition among gene-editing providers compress margins and influence clinical translation pacing.

- Regulatory clarity and IP stability become critical determinants of exit potential and cross-border collaboration.

Overview and Context of Crispr Cas9 in the Biotech Ecosystem

Crispr Cas9 has transformed the pace at which biological ideas move toward clinical reality. For startups, the ability to test multiple targets quickly can tilt funding timelines, attract collaboration partners, and alter burn rates. In markets, the technology shapes competitive dynamics, professional networks, and the emergence of therapeutic pipelines that blend in-house discovery with external expertise. When investors assess risk, they weigh not just science but the surrounding ecosystems—regulatory timelines, manufacturing scalability, and the resilience of IP positions.

Economic Impacts Of Crispr Cas9 On Biotech Startups And Markets

In this section, we examine how the Economic Impacts Of Crispr Cas9 ripple through startup strategies, market structure, and investor behavior. From capital formation to product pipelines, the gene-editing revolution reshapes competitive dynamics and expectations.

Investment and funding dynamics

Early funding cycles increasingly reward clear milestones tied to safety, efficacy signals, and scalable manufacturing plans. Venture capitalists weigh runways that align with regulatory expectations and demonstrate a path to value creation, even if near-term profits are modest. For startups, access to modular CRISPR platforms lowers upfront costs and helps assemble a diversified portfolio, spreading risk across multiple targets or diseases.

Market structure and competition

As more players enter the field, market structure shifts from exclusive, single-asset bets to diversified platform plays. This creates competition around enablers—delivery methods, screening pipelines, and data networks—while pricing strategies adjust to the value of personalized therapies and companion diagnostics. The result is a more dynamic landscape where collaboration and licensing become common routes to scale.

Policy, regulation, and IP

Policy advances and IP stability influence the speed of commercialization. Clear patent trajectories for CRISPR constructs, alongside predictable regulatory review processes, help startups forecast timelines and attract non-dilutive funding. Conversely, uncertainty around biosafety, off-target effects, or cross-border approvals can slow deployment and raise capital costs.

Future Outlook and Strategic Guidance

Looking ahead, the economic effects of Crispr Cas9 will hinge on how ecosystems manage risk, leverage collaboration, and translate scientific breakthroughs into scalable products. Startups that align scientific milestones with capital efficiency, regulators’ expectations, and patient-access goals are best positioned to capture value as markets mature.

What are the economic implications of Crispr Cas9 for early-stage biotech startups?

+Early-stage startups benefit from lower barriers to entry when using CRISPR platforms, enabling faster proof-of-concept and targeted experiments that attract seed and Series A capital. However, the economics remain sensitive to regulatory timelines, manufacturing costs, and the ability to protect IP. Smart founders align milestones with clear funding tranches, build diversified target portfolios, and seek strategic partnerships to de-risk clinical translation.

<div class="faq-container">

<div class="faq-item">

<div class="faq-question">

<h3>How does Crispr Cas9 affect market competition and pricing in gene-editing services?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Competition intensifies as service providers and platforms offer standardized editing pipelines, data networks, and automation. Pricing pressure emerges as scale and repeatability drive efficiency. Yet premium pricing can persist for complex, high-value edits or integrated therapeutic solutions with robust safety data and manufacturing capabilities.</p>

</div>

</div>

</div>

<div class="faq-container">

<div class="faq-item">

<div class="faq-question">

<h3>What policy and IP factors most influence the economic impacts of Crispr Cas9?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>IP stability around Cas9-related inventions, licensing terms, and freedom-to-operate analyses shape long-term returns for investors and licensees. Regulatory clarity—such as streamlined oversight for certain gene-edited therapies—and biosafety guidelines help startups forecast timelines and attract non-dilutive funding. Cross-border collaboration often hinges on alignment of patent regimes and export controls.</p>

</div>

</div>

</div>

<div class="faq-container">

<div class="faq-item">

<div class="faq-question">

<h3>What are the risks and opportunities for investors in Crispr Cas9-enabled startups?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Investors face scientific risk, manufacturing complexities, and regulatory hurdles, but also opportunities from scalable platform models, data-enabled discovery, and potential for cross-asset licensing. Diversification across targets, collaboration with established pharma, and backing teams with strong IP positions mitigate downside while unlocking exponent potential in precision medicine.</p>

</div>

</div>

</div>